A few years ago, I wrote an article for a materials innovator on the reshoring of manufacturing back to the United States and its possible implications. From the need for more materials as supply chains realign to the opening of innovation talent gaps, there are plenty of challenges that accompany the return of manufacturing to the country. More recently, I’ve heard chatter about the impact that the COVID-19 pandemic will have on the chemical and intermediates supply chain, echoing the challenges raised by reshoring.

With COVID-19, we are seeing the painful, and in some cases life-threatening, situations where severe shortages of essential raw materials and goods have hampered containment. As we chase the global goal of developing and manufacturing scale quantities of a viable vaccine, questions around rapid and sustainable raw material access have been raised. As demand has risen for drugs and supplies, so too have concerns about shortages. To counter this, President Trump and the Biomedical Advanced Research and Development Authority (BARDA), an office within the Department of Health and Human Services, recently awarded a $345 million contract to a group led by Phlow Corp. to make medicines that have fallen into short supply. But can decades of supply chain consolidation and its resultant manufacturing locales pivot as quickly as some would like to believe?

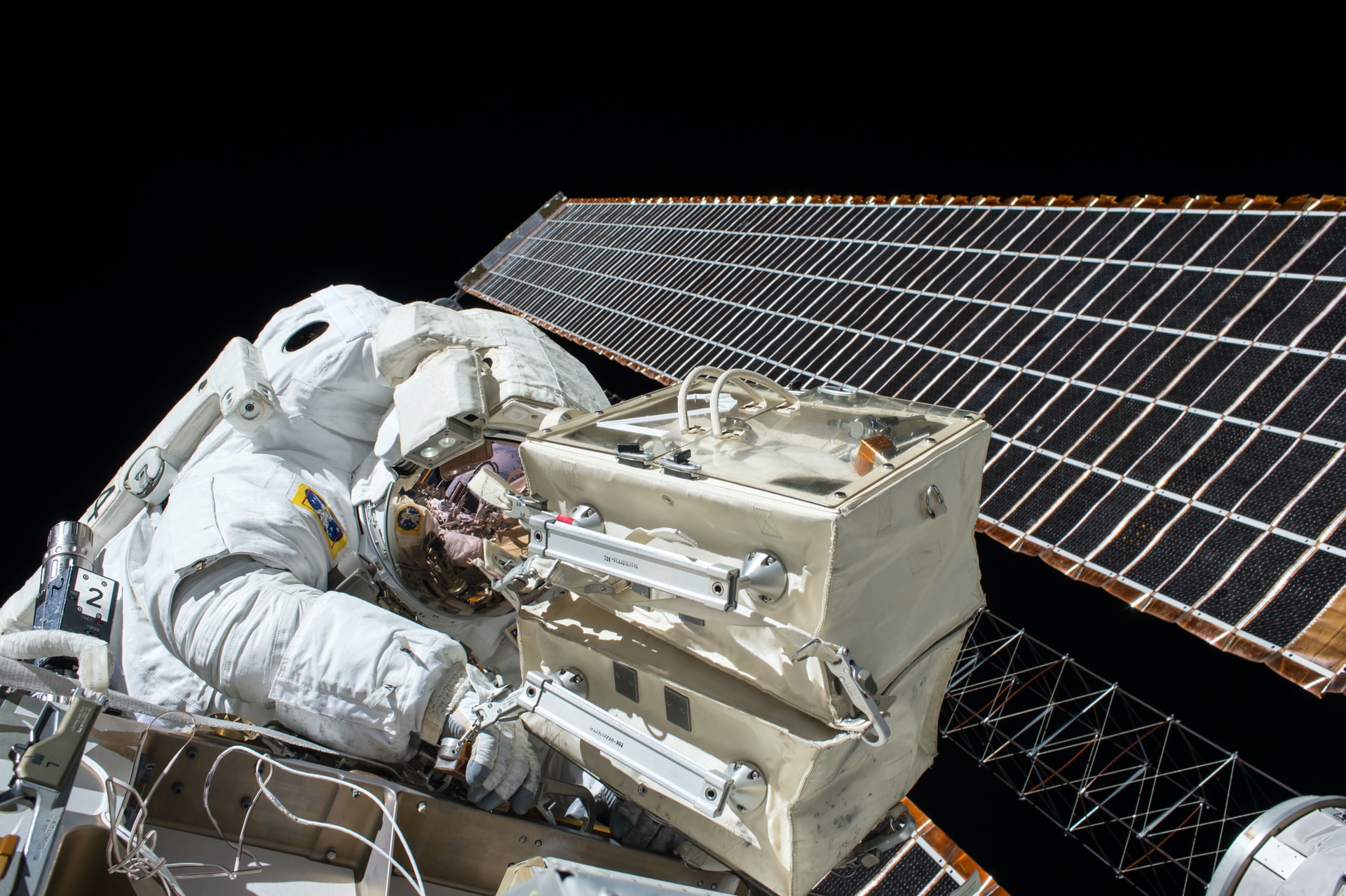

Several major industries are vulnerable at this time including consumer electronics, alternative energy, and the automotive industry, all of which are susceptible to offshore supply chains. Asian economies, in particular, have traditionally had a stronghold on electronic component materials. These have been either assembled overseas or, to meet certain “Made in America” criteria, found themselves subject to final assembly in North America. The pandemic recently forced a number of suppliers to shut down manufacturing plants in China to stem the COVID-19 tide, creating a North American domino effect. In the case of alternative energy, the critical anode and cathode minerals used in the lithium-ion batteries are only mined in certain geographies where access may be limited. A recent article evaluating the mineral commodity supply risk of the American manufacturing sector dissects this vulnerability in more detail. Despite this, the scenario is not homogenous. Many industries, such as the polymer and plastics sector, have insulated themselves from an upset in their supply chains through reliable access to raw material sources, contractual obligations, and long-standing onshore capabilities. The global chemical supply chain is also quite resilient. Given the impact of COVID-19 on supply chains, this may be time to diversify supplier sources and lock in critical forward contracts. As the pandemic continues to impact industries, the most successful businesses will be those who adjust their supply chain strategies.

Match Point Strategies is always monitoring the state of materials globally and continue to collaborate with customers on trends, sourcing, innovation and business strategies in this ever-changing world.